Stock Market Analysis 2025(August) : Detailed Report on Trends and Risks

Trends, risks, and pro tips for investors

A deep dive into what moved markets in August 2025 — and what to do about it.

Introduction – Why August 2025 Matters for Investors

Every so often, the stock market enters a phase that feels like a turning point. August 2025 is one of those moments.

The headlines are loud:

- The S&P 500 closed at a record-breaking 6,468.54.

- AI-powered companies continue to deliver jaw-dropping earnings.

- Yet, whispers of bubbles, trade tariffs, and inflation uncertainty are keeping investors awake at night.

That’s where a Stock Market Analysis 2025 comes in. In this guide, we’ll break down:

- What’s actually happening in August 2025

- The forces driving stock prices higher

- The risks that could quickly reverse the trend

- Practical steps you can take as an investor

By the end, you’ll feel confident—not overwhelmed—about navigating today’s market.

August 2025 Market Overview: Highs With Hidden Lows

Let’s start with a big-picture look.

On the surface:

- S&P 500 all-time high: Crossing 6,468.54 was a milestone celebrated across trading floors. S&P 500 hits record highs – CNBC.

- Dow and Nasdaq followed suit, gained by strong earnings, especially from tech and AI-driven firms.

But beneath the surface, it’s not all smooth.

- Bank of America has publicly compared today’s market conditions to the dot-com bubble of the 1990s and the pre-2008 crash environment. Bank of America warns of bubble risks – Reuters.

- Tariff uncertainty has returned as trade disputes flare up globally.

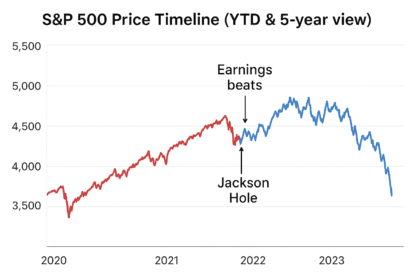

- The Federal Reserve’s Jackson Hole meeting later this month could be a tipping point. Some analysts even warn of a 15% market drop depending on Jerome Powell’s tone.

In other words: the party is going strong, but the floorboards are creaking.

Trend Spotlight: What’s Fueling the Rally?

So why is the market still climbing in August 2025 despite these risks? There are three key drivers.

1. AI and Big Tech Dominance

This has been the year of AI.

- Morgan Stanley estimates AI adoption could add $16 trillion to the S&P 500’s long-term value. Morgan Stanley on AI-driven growth – Bloomberg.

- Companies like Microsoft, Nvidia, and Alphabet are posting record profits, driven by demand for AI chips, cloud computing, and automation tools.

- The so-called “Magnificent Seven” now make up over 30% of the S&P 500’s value.

This dominance creates both momentum and risk. Investors are piling in because AI looks like the future, but such overconcentration means any stumble could ripple across the entire market.

2. Strong Corporate Earnings

One surprising factor: earnings have been much stronger than expected.

- Nearly 90% of companies in the S&P 500 beat expectations this quarter.

- Tech is the clear leader, but even sectors like industrials and consumer goods posted healthy numbers.

- The contrast: energy stocks and certain manufacturing firms are still struggling due to global demand slowdowns.

For now, the earnings strength is what’s keeping optimism alive.

3. Investor Sentiment and FOMO

Market psychology can’t be underestimated.

- Retail investors are returning, encouraged by record highs.

- Many new investors are driven by FOMO (Fear of Missing Out) on the AI boom.

- Institutional investors, while cautious, are still allocating capital because sitting on the sidelines means underperformance.

This combination is like fuel poured on a campfire—it burns brighter, but it also risks flaring out suddenly.

Risk Radar: Why Investors Should Stay Alert

For every bullish driver, there’s a risk lurking. Let’s break down the most pressing concerns in August 2025.

1. Valuation Bubbles

When stock prices rise faster than company earnings, you get a bubble.

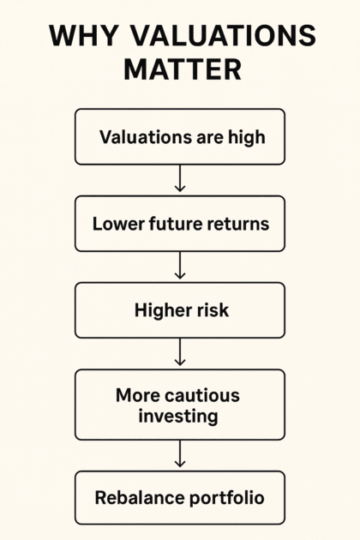

- The S&P’s forward price-to-earnings (P/E) ratio is 22.2, compared to its 10-year average of 18.5. Stock Valuation Metrics – FactSet.

- That doesn’t sound like much, but historically, markets trading far above averages tend to correct.

- Bank of America calls today’s setup “eerily similar” to the late 1990s before the dot-com bust.

This doesn’t mean a crash is certain, but it means volatility is almost guaranteed.

2. Federal Reserve Policy & Jackson Hole

The Fed remains the wild card.

- Inflation is cooling, but not as fast as policymakers want.

- Interest rates are still restrictive, and Powell’s Jackson Hole speech later this month could signal either rate cuts (bullish) or more patience (bearish).

- Evercore ISI has even warned investors to brace for a 15% market drop if Powell delivers a hawkish message.

In short: one speech could set the market’s direction for the rest of 2025.

3. Geopolitical and Trade Risks

Markets don’t operate in a vacuum.

- Tariff disputes have resurfaced, particularly between the U.S. and key Asian partners.

- Supply chain disruptions in energy and semiconductors are adding uncertainty.

- Any escalation could spook markets already stretched on valuation.

4. Market Concentration Risk

As mentioned, a handful of mega-cap tech stocks are carrying the market.

- If one or two stumble, the entire S&P 500 could be dragged down.

- The Magnificent Seven now resemble the “Nifty Fifty” of the 1970s—a handful of stocks everyone thought were invincible, until they weren’t.

This concentration risk is one reason strategists are urging diversification.

Practical Guidance: What Should Investors Do Now?

If you’re a beginner or intermediate investor, you might be wondering: “Okay, so what do I actually do with this information?”

Here are practical, low-stress steps to navigate August 2025:

- Diversify Beyond Tech

- Don’t let your portfolio become overexposed to AI and Big Tech.

- Look at sectors like healthcare, energy, and consumer staples, which are trading at more reasonable valuations.

- Use Dollar-Cost Averaging (DCA)

- Instead of trying to time the market, invest a fixed amount every month.

- This reduces the risk of buying at the peak and helps you stay consistent. Dollar-Cost Averaging Explained – Investopedia.

- Balance Growth With Defense

- Mix high-growth stocks with defensive plays like dividend ETFs, bonds, or gold.

- These can act as shock absorbers if volatility spikes.

- Keep Emotions in Check

- Don’t chase stocks just because they’re “hot.”

- Stick to your long-term strategy and resist panic selling during dips.

- Watch Key Market Events

- The Jackson Hole meeting later this month.

- Corporate earnings season.

- Inflation and jobs reports.

Being aware of these can help you avoid surprises.

Winners and Losers in August 2025

- Tech & AI: Leading growth but facing bubble concerns.

- Healthcare: Steady gains as investors seek defensive plays.

- Energy: Struggling with global demand slowdowns and supply chain risks.

- Consumer Staples: Attracting cautious investors due to stability.

- Financials: Benefiting from higher interest rates but vulnerable to policy changes.

Looking Ahead: Lessons From August 2025

What does August 2025 Stock Market Analysis teach us about investing?

- AI is transformative—but hype is not a strategy. The future is bright, but valuations matter.

- Diversification is timeless. Overconcentration in a handful of names is dangerous.

- Policy and politics matter as much as profits. Tariffs, Fed decisions, and global tensions can change sentiment overnight.

- Patience wins. Short-term traders may panic, but long-term investors who stay disciplined usually come out ahead. World Bank Economic Updates.

Conclusion – Stay Excited, But Stay Prepared

The story of August 2025 is a tale of two markets:

- One that’s riding high on AI-fueled optimism.

- Another that’s quietly warning us not to get carried away.

As an investor, your job isn’t to predict the next crash or rally. It’s to stay ready, calm, and informed—building a portfolio that can weather both.

Remember:

- Don’t let headlines control your strategy.

- Stick with diversification and dollar-cost averaging.

- Keep learning, because markets change—but principles of smart investing do not.

This is what makes a trustworthy Stock Market Analysis 2025 more than just numbers: it’s about preparing you to succeed for the long run.

Why is the stock market at record highs in August 2025?

AI earnings, strong corporate profits, and investor sentiment are the main drivers.

What risks should investors watch in 2025?

High valuations, Fed policy shifts, trade disputes, and tech concentration.

What’s the best investing strategy in 2025?

Diversification, dollar-cost averaging, and balancing growth with defensive assets.

Is AI fueling a bubble in 2025?

AI is transformative, but valuations may be stretched—making risk management critical.

What role does the Federal Reserve play in Stock Market Analysis 2025?

The Fed’s policies on interest rates and inflation control are a major driver of market sentiment, especially around events like the Jackson Hole meeting.

Is the S&P 500 overvalued in 2025?

Yes, current valuations are above historical averages, which increases the risk of a correction even if fundamentals remain strong.